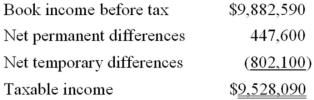

B&B Inc.'s taxable income is computed as follows.  Using a 34% rate, compute B&B's tax expense per books and tax payable.

Using a 34% rate, compute B&B's tax expense per books and tax payable.

Definitions:

Homeownership

The state or condition of owning a house or residence.

Employment

The state of having a paid job or occupation, including full-time, part-time, and freelance positions.

Gender-Specific

Pertaining or relating exclusively to the characteristics of one sex or the social differences between male and female.

Language Barrier

A communication obstacle arising when people who speak different languages attempt to converse or share information.

Q9: Delour Inc. was incorporated in 2004 and

Q17: Which of the following statements concerning sales

Q19: Conant Company purchased only one item of

Q28: Tabco Inc., a calendar year, accrual basis

Q46: The final step in the tax research

Q56: Effective tax research often omits the first

Q63: LiO Company transferred an old asset with

Q81: Delta Inc. generated $668,200 ordinary income from

Q97: Princetown Inc. has a $4.82 million basis

Q109: The sale of business inventory always generates