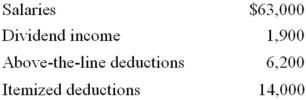

Mr. and Mrs. Dell, ages 29 and 26, file a joint return and have no dependents for the year. Here is their relevant information.  Compute their adjusted gross income (AGI) and taxable income.

Compute their adjusted gross income (AGI) and taxable income.

Definitions:

Markov Analysis

A statistical technique used to forecast the future behavior of a system or process based on its current state and known transition probabilities.

SWOT Analysis

A comparison of strengths, weaknesses, opportunities, and threats for strategy formulation purposes.

HRIS Supervisor's

The individual responsible for overseeing the Human Resource Information System (HRIS), ensuring the management, input, and accuracy of employee data and information systems.

Statistical Analysis

The process of collecting, examining, interpreting, and presenting data to discover underlying patterns and trends.

Q30: An individual's taxable income equals adjusted gross

Q50: Six years ago, HOPCO granted Ms. Cardena

Q57: Which of the following would qualify as

Q64: Fleming Corporation, a U.S. multinational, has pretax

Q71: The value of a nontaxable fringe benefit

Q74: Contributions of property to S corporations are

Q79: An inter vivos transfer is a gratuitous

Q83: A family partnership can be used to

Q85: Every year, the IRS selects a certain

Q91: Which of the following itemized deductions is