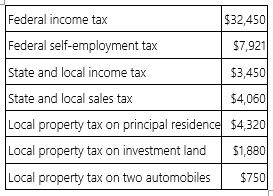

Mr. Jain paid the following taxes this year.

Compute Mr. Jain's itemized deduction for taxes.

Compute Mr. Jain's itemized deduction for taxes.

Definitions:

Rescission

The legal act of voiding a contract and returning all involved parties to their pre-contractual positions, often due to misrepresentation, fraud, or error.

Compensatory

Referring to a form of damages awarded to a plaintiff in a lawsuit to compensate for lost items, damage, or injury.

Breach of Contract

Happens when a party does not meet their contractual duties, enabling the other party to pursue legal solutions.

Benefit of His Bargain

A principle in contract law that entitles a party to expect the benefits promised in an agreement, often in the context of damages for breach.

Q3: The personal holding company tax is a

Q5: Fleming Corporation, a U.S. multinational, has pretax

Q12: Investment interest expense is a miscellaneous itemized

Q31: Bart owns 100% of an S corporation

Q58: Article 1 of the U.S. Constitution, referred

Q59: Mr. and Mrs. Bolt's joint return reports

Q62: Adam and Barbara formed a partnership to

Q81: F&D Inc. ceased operations and dissolved under

Q90: Start-up losses of a new business operation

Q106: Jay Blount, 26-years old and a full