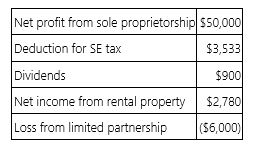

Mr. and Mrs. Nelson operate a small business as a sole proprietorship. This year, they have the following tax information.  Compute Mr. and Mrs. Nelson's AGI.

Compute Mr. and Mrs. Nelson's AGI.

Definitions:

Motivating Force

A psychological or physiological factor that drives an individual towards a goal or satisfies a need.

Behavior

The actions, reactions, or mannerisms exhibited by individuals, often studied in psychology to understand and predict human motives and development.

Pessimistic

A tendency to see the worst aspect of things or believe that the worst will happen; a lack of hope or confidence in the future.

Conscious Forces

Psychological elements within an individual’s awareness that influence thoughts, feelings, and actions.

Q8: Mr. Pearl's total income and self-employment tax

Q17: This year, Sutton Corporation's before-tax income was

Q34: Which of the following statements regarding the

Q35: Which of the following is not considered

Q35: Ms. Watts owns stock in two S

Q58: Mrs. Jansen is the sole shareholder of

Q59: Self-employed individuals have fewer opportunities than employees

Q67: Palm Corporation has book income of $424,000.

Q68: Which of the following is NOT one

Q93: Which of the following statements about an