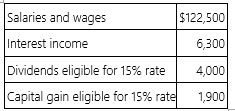

Mr. and Mrs. Daniels, ages 45, and 42, had the following income items in 2015:  Mr. and Mrs. Daniels have no dependents and claim the standard deduction. Compute their income tax liability on a joint return.

Mr. and Mrs. Daniels have no dependents and claim the standard deduction. Compute their income tax liability on a joint return.

Definitions:

Appendicular Skeleton

Part of the skeleton that includes the bones of the limbs and the pectoral and pelvic girdles, facilitating movement.

Cavitiy

A hollow space within the body or one of its organs; however, the correct spelling is "cavity."

Skull

The bone structure that forms the head, protecting the brain and supporting the structures of the face.

Intramembranous Ossification

Intramembranous ossification is a process of bone development in which bone tissue is directly formed from mesenchymal tissue without first being cartilage.

Q2: Bisou Inc. made a $48,200 contribution to

Q3: The unearned income Medicare contribution tax applies

Q4: Harold Biggs is provided with $200,000 coverage

Q6: Mrs. Claire underpaid her 2014 federal income

Q15: A corporation that is unable to meet

Q36: Lexington Associates, Inc. is a personal service

Q50: Platte River Corporation is a calendar year

Q57: Which of the following statements regarding corporate

Q83: Haddie's Hats is a regular corporation. The

Q97: Lincoln Corporation, which has a 34% marginal