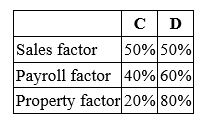

Albany, Inc. does business in states C and D. State C apportions income using an equally-weighted three-factor formula; state D uses an apportionment formula that double-weights the sales factor. Albany's before tax income is $3,000,000, and its sales, payroll, and property factors are as follows.

Calculate Albany's income taxable in each state.

Definitions:

State Charters

State charters refer to authorization or licenses granted by state governments allowing entities, such as corporations or banks, to operate within a specific state.

Money Supply

The aggregate sum of funds available or in circulation within a nation.

M1

A category of the money supply that includes all physical money, such as coins and currency, as well as demand deposits, traveler's checks, and other checkable deposits.

Money

A medium of exchange that facilitates transactions, serving as a unit of account, a store of value, and sometimes, a standard of deferred payment.

Q7: Interest paid on home equity debt is

Q17: Mr. and Mrs. Reece couldn't complete their

Q25: Calliwell Corporation is a Colorado corporation engaged

Q44: Eliot Inc. transferred an old asset with

Q58: Mr. Lightfoot owns three mortgaged residences that

Q60: Ms. Regga, a physician, earned $375,000 from

Q96: Mr. Eddy loaned his solely-owned corporation $3,000,000.

Q101: The corporate characteristic of limited liability is

Q102: Transfer pricing issues arise:<br>A) When tangible goods

Q113: Mr. and Mrs. Daniels, ages 45, and