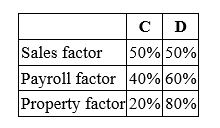

Albany, Inc. does business in states C and D. State C uses an apportionment formula that double-weights the sales factor; state D apportions income using an equally-weighted three-factor formula. Albany's before tax income is $3,000,000, and its sales, payroll, and property factors are as follows. Calculate Albany's income taxable in each state.

Calculate Albany's income taxable in each state.

Definitions:

Inheritable Traits

Characteristics or attributes that are passed from parents to offspring through genes.

Severely Malnourished

A condition where an individual lacks essential nutrients due to inadequate food intake, leading to serious health problems.

IQ Gap

The observed disparity in average IQ scores between various groups, often discussed in the context of socio-economic, educational, or racial groups.

Mental Module

A hypothesized structure in the brain theorized to be responsible for specific cognitive functions, as part of the modular view of mental processes.

Q14: Gerry is the sole shareholder and president

Q39: A corporation's tax basis in property received

Q57: Babex Inc. and OMG Company entered into

Q78: Which of the following government transfer payments

Q84: Loraine Manufacturing, Inc. reported the following for

Q86: Mr. Gray recognized a $60,000 loss on

Q86: Which of the following items is included

Q101: Nagin Inc. transferred an old asset in

Q102: Yelano Inc. exchanged an old forklift used

Q112: Mr. and Mrs. Harvey's tax liability before