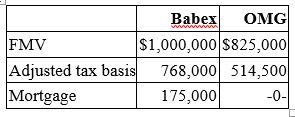

Babex Inc. and OMG Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, OMG assumed the mortgage on the Babex property. Compute OMG's gain recognized on the exchange and its tax basis in the property received from Babex.

Pursuant to the exchange, OMG assumed the mortgage on the Babex property. Compute OMG's gain recognized on the exchange and its tax basis in the property received from Babex.

Definitions:

Seljuk Turks

A major Islamic medieval dynasty originating from Central Asia, which played an important role in the history of the Middle East during the 11th and 12th centuries.

Michael VIII

Emperor Michael VIII Palaiologos was the founder of the Palaiologan dynasty that ruled the Byzantine Empire from 1259 to 1453, known for restoring the Byzantine Empire's fortunes after the Latin Empire.

Pantokrator

A specific depiction of Christ in Christian iconography, representing him as the all-powerful ruler of the universe, often seen in Byzantine art.

Monreale

A town in Sicily, Italy, known for its Norman cathedral, which features extensive mosaics and is a masterpiece of Norman architecture.

Q14: A significant advantage of issuing stock instead

Q17: Purchased goodwill is amortizable both for book

Q21: Waters Corporation is an S corporation with

Q22: Taxable income is defined as gross income

Q25: A family partnership can shift taxable income

Q49: An asset's adjusted book basis and adjusted

Q60: Stack Inc. owns a $1 million insurance

Q61: On November 7, a calendar year business

Q79: The foreign tax credit is available for

Q114: PPQ Inc. wants to change from a