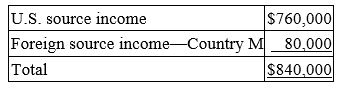

Mega, Inc., a U.S. multinational, has pretax U.S. source income and foreign source income as follows.  Mega paid $20,000 income tax to Country M. Mega has a $25,000 foreign tax credit carryforward. What is Mega's U.S. tax liability if it takes the foreign tax credit?

Mega paid $20,000 income tax to Country M. Mega has a $25,000 foreign tax credit carryforward. What is Mega's U.S. tax liability if it takes the foreign tax credit?

Definitions:

Limited

Confined within bounds; restricted in extent, number, scope, or action.

Mid-1970s

The period denoting the middle years of the 1970s decade, often associated with significant cultural, political, and technological changes.

Taser

A brand of conducted electrical weapon that uses electrical current to disrupt voluntary control of muscles, used for incapacitating a person temporarily.

Developed

Refers to a state of advanced economic and social growth in a country or region.

Q6: Samantha died on January 18, 2014. Her

Q11: An employee recognizes taxable income if his

Q15: Lexington Corporation conducts business in four states.

Q32: Which of the following statements regarding corporate

Q37: The accumulated earnings tax is imposed on

Q44: Mrs. Ford, who has a 39.6% marginal

Q52: Which of the following is not a

Q52: The United States taxes its citizens on

Q56: The IRS agent who audited the Form

Q87: Dividends-received deductions generally are not allowed for