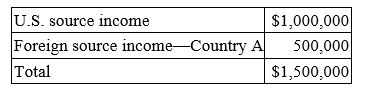

Fleming Corporation, a U.S. multinational, has pretax U.S. source income and foreign source income as follows.  Fleming paid $200,000 income tax to Country

Fleming paid $200,000 income tax to Country

Definitions:

Online Community

A virtual community where individuals gather and interact through the internet, sharing common interests or goals.

Communications

The act or process of using words, sounds, signs, or behaviors to express or exchange information.

Level Of Participation

The degree or extent to which individuals or entities are actively involved or engaged in an activity or process.

Democracy

A system of government in which power is vested in the people, who rule either directly or through freely elected representatives.

Q6: WEK Inc. is a New York corporation

Q16: Which of the following statements concerning extensions

Q36: During a recent IRS audit, the revenue

Q44: Lars withdrew $20,000 from a retirement account

Q49: Sunny Daze, Inc., a publicly held company,

Q52: Which of the following is not a

Q62: A corporate shareholder usually cannot be held

Q65: The classification of a worker as an

Q85: Alex is a partner in a calendar

Q96: Mr. Eddy loaned his solely-owned corporation $3,000,000.