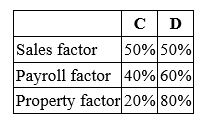

Albany, Inc. does business in states C and D. State C apportions income using an equally-weighted three-factor formula; state D uses an apportionment formula that double-weights the sales factor. Albany's before tax income is $3,000,000, and its sales, payroll, and property factors are as follows.

Calculate Albany's income taxable in each state.

Definitions:

Automatic Stabilizers

Economic policies and programs designed to offset fluctuations in a nation's economic activity without additional government action, such as progressive tax systems and welfare.

Inflation

An overall uptick in price levels and a decline in the value of money.

Liberal Economist

An economist advocating for policies promoting free market principles, minimal government intervention, and individual liberties in economic matters.

Government Spending Cuts

Government Spending Cuts involve the reduction of public sector expenditure in an attempt to balance budgets and reduce deficits.

Q3: If a U.S. multinational corporation incurs start-up

Q4: Loonis Inc. and Rhea Company formed LooNR

Q10: Which of the following statements about the

Q23: Grant and Amy have formed a new

Q44: Mr. and Mrs. David file a joint

Q57: Babex Inc. and OMG Company entered into

Q62: The purpose of Schedule M-1 is to

Q65: Mr. Longwood and Mrs. Kennett are the

Q82: A taxpayer who receives boot in a

Q87: Cramer Corporation and Mr. Chips formed a