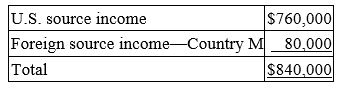

Mega, Inc., a U.S. multinational, has pretax U.S. source income and foreign source income as follows.  Mega paid $20,000 income tax to Country M. Mega has a $25,000 foreign tax credit carryforward. What is Mega's U.S. tax liability if it takes the foreign tax credit?

Mega paid $20,000 income tax to Country M. Mega has a $25,000 foreign tax credit carryforward. What is Mega's U.S. tax liability if it takes the foreign tax credit?

Definitions:

Early Recollections

Memories from the initial years of life, often used in therapy to uncover insights about an individual's personality.

MMPI

Minnesota Multiphasic Personality Inventory, a standardized psychometric test of adult personality and psychopathology used to assess and diagnose mental disorders.

Paranoia Scale

A psychological assessment tool designed to measure levels of paranoia or paranoid thoughts in individuals.

Social Introversion

A personality trait characterized by a preference for solitary activities and reservations about participating in social situations.

Q15: Lexington Corporation conducts business in four states.

Q23: Mrs. Lex realized a $78,400 gain on

Q47: Which of the following statements concerning the

Q53: Mr. and Mrs. Reid reported $435,700 ordinary

Q70: Personal exemptions are allowed in computing alternative

Q76: Electing to reinvest dividends in additional shares

Q87: Which of the following statements about organizational

Q92: Toffel Inc. exchanged investment land subject to

Q107: Traditional IRAs but not Roth IRAs are

Q112: Mr. and Mrs. Harvey's tax liability before