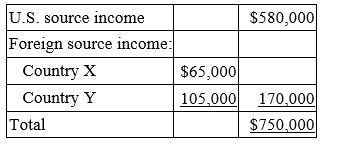

Many Mountains, Inc. is a U.S. multinational corporation. This year, it had the following income.  Many Mountains paid $15,000 income tax to Country X and $28,500 income tax to Country Y. Compute Many Mountains' allowable foreign tax credit.

Many Mountains paid $15,000 income tax to Country X and $28,500 income tax to Country Y. Compute Many Mountains' allowable foreign tax credit.

Definitions:

Regression Analysis

A statistical method used for estimating the relationships among variables, often for predicting a dependent variable from one or more independent variables.

Entering GPA

The grade point average of students at the time they are admitted into an educational institution.

Regression Line

A line through a scatterplot of data points that best expresses the relationship between those points, typically used in linear regression to predict the outcome variable from the predictor variable.

Proficiency Test

An assessment designed to measure an individual's knowledge or competence in a specific area or discipline.

Q4: Gary is a successful architect who also

Q7: The corporate characteristic of free transferability exists

Q21: Lindsey owns and actively manages an apartment

Q26: Galaxy Corporation conducts business in the U.S.

Q52: Which of the following is not a

Q59: Self-employed individuals have fewer opportunities than employees

Q60: Which of the following statements regarding the

Q60: Which of the following statements regarding the

Q85: Carl had $2,000 gambling winnings and $8,400

Q100: Frederick Tims, a single individual, sold the