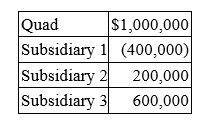

The Quad affiliated group consists of Quad, a Delaware corporation, and its three wholly-owned subsidiaries. This year, the four corporations report the following net income (loss) .  If Quad elects to file a consolidated U.S. tax return, compute consolidated taxable income assuming that subsidiaries 1 and 2 are domestic corporations and subsidiary 3 is a foreign corporation.

If Quad elects to file a consolidated U.S. tax return, compute consolidated taxable income assuming that subsidiaries 1 and 2 are domestic corporations and subsidiary 3 is a foreign corporation.

Definitions:

Immune Function

The activities and mechanisms through which an organism's immune system identifies and eliminates pathogens and unhealthy cells.

Vitamin E

A group of eight fat-soluble compounds that are important for maintaining healthy skin and a strong immune system.

Zinc

A chemical element with the symbol Zn, essential for human health, involved in numerous aspects of cellular metabolism.

Calcium

A chemical element, symbol Ca, essential for living organisms, particularly in cell physiology and bone formation.

Q10: Jason, a single individual, is employed by

Q12: Loonis Inc. and Rhea Company formed LooNR

Q13: The abandonment of business equipment with a

Q30: In terms of dispersal of ownership, corporations

Q31: Mr. McCann died this year. During his

Q60: The foreign subsidiaries of a U.S. corporation

Q63: Forward Inc.'s book income of $739,000 includes

Q64: A corporation's minimum tax credit can reduce

Q72: Mr. Gordon, a resident of Pennsylvania, paid

Q93: Albany, Inc. does business in states C