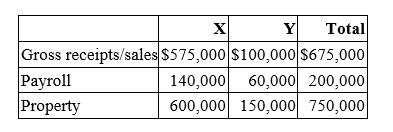

Origami does business in states X and Y. State X uses an equally-weighted three-factor apportionment formula and has a 4 percent state tax rate. State Y uses an apportionment formula that double-weights the sales factor and has a 6 percent tax rate. Cromwell's taxable income, before apportionment, is $3 million. Its sales, payroll, and property information are as follows.

a. Calculate Origami's apportionment factors, income apportioned to each state, and state tax liability.

a. Calculate Origami's apportionment factors, income apportioned to each state, and state tax liability.

b. State Y is considering changing its apportionment formula to a single sales factor. Given its current level of activity, would such a change increase or decrease Origami's state income tax burden? Provide calculations to support your conclusion

Definitions:

Role Ambiguities

Uncertainties faced by employees regarding their job roles, expectations, and responsibilities within an organization.

Substantive Conflict

A disagreement over goals, resources, rewards, policies, or procedures that has a significant impact on the tasks or outcomes.

Emotional Conflict

A situation where a person experiences mixed feelings or emotions about a decision, situation, or person, leading to internal turmoil or struggle.

Proxemics

The study of human use of space and the effects that population density has on behavior, communication, and social interaction.

Q2: On January 1, 2015, Laura Wang contributed

Q14: Mr. Wang's corporate employer transferred him from

Q24: Under the U.S. tax system, a domestic

Q29: Which of the following is a primary

Q30: Alice is a partner in Axel Partnership.

Q63: Mr. and Mrs. Dell, ages 29 and

Q68: Which of the following is excluded from

Q72: In 2015, Amanda earned $70,000 self-employment income.

Q86: A fire destroyed equipment used by BLP

Q97: The standard deduction for single individuals equals