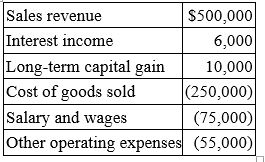

Waters Corporation is an S corporation with two equal shareholders, Mia Jones and David Kerns. This year, Waters recorded the following items of income and expense:  Waters distributed $25,000 to each of its shareholders during the year. If Mia has no other sources of income, what is her gross income for the year?

Waters distributed $25,000 to each of its shareholders during the year. If Mia has no other sources of income, what is her gross income for the year?

Definitions:

Purchasing Department

A division within a business that is responsible for acquiring goods and services necessary for the organization's operations.

RFP

An acronym for Request for Proposal, a document that solicits proposals, often through a bidding process, by an agency or company interested in procurement of a commodity, service, or valuable asset.

Conciseness

The quality of being brief and to the point, eliminating unnecessary words without sacrificing clarity.

Microblogging

A form of blogging that allows users to write brief text updates (usually less than 200 characters) and publish them, either to be viewed by anyone or by a restricted audience.

Q6: Murrow Corporation generated $285,700 income from the

Q51: Loretta is the sole shareholder of Country

Q57: Brenda sold investment land for $200,000 in

Q59: Addis Company operates a retail men's clothing

Q68: Franton Co., a calendar year, accrual basis

Q76: An individual who files his own tax

Q85: Corporations are required to pay their federal

Q88: In 2014, TPC Inc. sold investment land

Q95: Foreign value-added taxes and excise taxes are

Q95: Which of the following entities does not