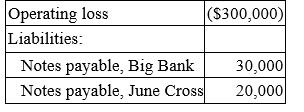

Funky Chicken is a calendar year S corporation with the following current year information:  On January 1 June Cross bought 60% of Funky Chicken for $45,000. She then loaned the company $20,000. How much of the operating loss may Cross deduct on her Form 1040?

On January 1 June Cross bought 60% of Funky Chicken for $45,000. She then loaned the company $20,000. How much of the operating loss may Cross deduct on her Form 1040?

Definitions:

Rehiring Former Employees

The practice of employing individuals who previously worked for the organization and have left but are now returning, often benefiting from their prior experience and familiarity with the company.

Conflict

a serious disagreement or argument, typically a protracted one between individuals, groups, or nations.

Private Employment Agencies

Agencies that assist individuals in finding employment and help companies to fill vacancies.

Unskilled Job Applicants

Individuals seeking employment who lack specific training or qualifications for the positions they apply for.

Q2: The majority of individual taxpayers take the

Q20: Jovar Inc., a U.S. multinational, began operations

Q32: When the personal holding company tax was

Q32: A limited liability company with more than

Q35: Perry Inc. and Dally Company entered into

Q52: A shareholder in an S corporation includes

Q54: Transfer prices cannot be used by U.S.

Q72: Mr. and Mrs. King's regular tax liability

Q72: Zeron Inc. generated $1,349,600 ordinary income from

Q93: Albany, Inc. does business in states C