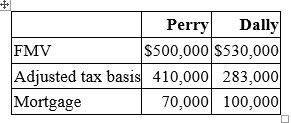

Perry Inc. and Dally Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

Definitions:

Antianxiety Drugs

Medications used to relieve anxiety by affecting the brain chemistry.

Electroconvulsive Therapy

A medical treatment involving electric currents passed through the brain to trigger a brief seizure, aiming to relieve severe mental health conditions.

Electric Shock

A sudden discharge of electricity through a part of the body, causing neurological and muscular reaction, sometimes used therapeutically.

Cortical Seizure

A seizure that originates in the cerebral cortex of the brain, often affecting motor, sensory, or psychological functions.

Q13: Which of the following is not a

Q25: Three years ago, ChaGo Inc. sold a

Q32: A limited liability company with more than

Q35: JG Inc. recognized $690,000 ordinary income, $48,000

Q46: Waters Corporation is an S corporation with

Q68: Experienced tax professionals generally can answer most

Q70: Because of conflicts of interest, shareholders are

Q84: In March, a flood completely destroyed three

Q92: Which of the following statements regarding the

Q116: In its current tax year, PRS Corporation