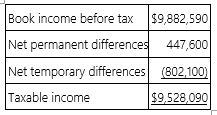

B&B Inc.'s taxable income is computed as follows.  B&B's tax rate is 34%. Which of the following statements is true?

B&B's tax rate is 34%. Which of the following statements is true?

Definitions:

Exchange Rate

The price at which one currency can be exchanged for another, influencing international trade and economics.

Lawn Mower

A machine utilizing one or more revolving blades to cut a grass surface to an even height.

Future Price Increase

An anticipated rise in the cost of goods or services over time.

Purchases

The action of acquiring goods or services in exchange for money; transactions involving the buying of products.

Q11: Mr. and Mrs. Boln earn $63,000 annual

Q22: Norwell Company purchased $1,413,200 of new business

Q33: Andrea Mitchell can shift income to her

Q58: Fantino Inc. was incorporated in 2013 and

Q69: Tabco Inc., a calendar year, accrual basis

Q70: The U.S. government has jurisdiction to tax

Q76: Which of the following statements concerning judicial

Q77: The business purpose doctrine allows the IRS

Q94: The goodwill of one business is never

Q95: Which of the following statements most accurately