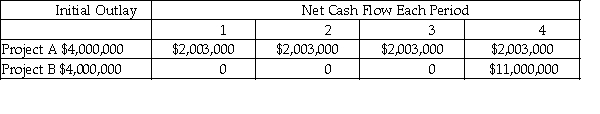

Consider the following two projects:  a.Calculate the net present value of each of the above projects,assuming a 14 percent discount rate.

a.Calculate the net present value of each of the above projects,assuming a 14 percent discount rate.

b.What is the internal rate of return for each of the above projects?

c.Compare and explain the conflicting rankings of the NPVs and IRRs obtained in parts a and b above.

d.If 14 percent is the required rate of return,and these projects are independent,what decision should be made?

e.If 14 percent is the required rate of return,and the projects are mutually exclusive,what decision should be made?

Definitions:

Tape Recorder

An electronic device used for recording sound on magnetic tape and for playing back recorded sound.

Associate Tastes

The phenomenon whereby an individual develops a preference for or aversion to certain flavors based on past experiences.

Poison

Substances that cause harm, illness, or death when ingested, inhaled, or absorbed into the body in relatively small amounts.

Lights And Sounds

Refers to the stimulation of the visual and auditory systems by photons (light) and oscillations of air particles (sound), respectively, and their perception and interpretation by the brain.

Q3: After a stock split of 2:1,each investor

Q10: JPR Company's preferred stock is currently selling

Q23: Cyberco Corporation has 5 million shares of

Q25: Charlie Corporation has two bonds outstanding.Both bonds

Q35: The Meacham Tire Company is considering two

Q52: Trinitron,Inc.purchased a new molding machine for $85,000.The

Q60: What provision entitles the common shareholder to

Q79: The current yield is greater than the

Q96: The "bird-in-the-hand" dividend theory suggests that<br>A)high dividends

Q143: The required rate of return reflects the