Returns on Investment

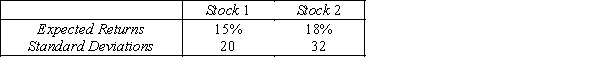

An analysis of the stock market produces the following information about the returns of two stocks.  Assume that the returns are positively correlated with correlation coefficient of 0.80.

Assume that the returns are positively correlated with correlation coefficient of 0.80.

-{Returns on Investment Narrative} Find the mean of the return on a portfolio consisting of an equal investment in each of the two stocks.

Definitions:

Price Collusion

An illegal practice where competing companies agree on price levels rather than competing, harming consumer interests.

Price Fixing

An illegal practice where businesses agree on prices for their products or services, rather than letting competition in the marketplace determine them.

Price Signaling

The act of changing prices to convey information to consumers and competitors about a product's quality, demand, or supply.

Competitors' Prices

The pricing levels set by firms operating in the same market space, which influence pricing strategies and market positioning.

Q9: {Hobby Shop Sales Narrative} What is the

Q32: A marketing research firm selects a random

Q39: An unbiased estimator is said to be

Q48: Which of the following situations lends itself

Q113: A national standardized testing company can tell

Q143: {{Post Office Narrative} Find the probability that

Q148: If event A and event B cannot

Q155: If P(A)= 0.65,P(B)= 0.58,and P(A and B)=

Q169: Z<sub>.025</sub> is the value of Z such

Q229: Prior probabilities can be calculated using the