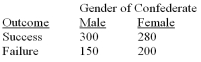

The following table includes the results of a 2 × 2 design in which one independent variable was the gender of a research confederate leading a group discussion (male or female) and the second independent variable was the outcome of the group performance (success or failure) .Both variables were manipulated by the experimenter using random groups designs.The dependent variable was participants' rating of the confederate leading the discussion.There is an interaction effect in this experiment.Which of the following statements is appropriate for describing the interaction effect?

Definitions:

Hedge Portfolios

Investment portfolios designed to reduce the risk of adverse price movements in an asset, often by using derivatives such as options and futures.

Risk Premiums

The extra return expected by investors for taking on the risk of an investment compared to a risk-free asset.

Mean-variance Efficient

A portfolio that offers the highest expected return for a defined level of risk or the lowest risk for a given level of expected return.

CAPM

The Capital Asset Pricing Model is a conceptual model employed to calculate the anticipated return on an investment, taking into account both the risk associated with the investment and the time value of money.

Q1: Compared to random starting order with rotation,an

Q19: The most common type of graph in

Q20: Why did Christo and Jeanne-Claude chose to

Q29: What characterized the new architecture known as

Q32: Why did the London-formed Independents call their

Q35: What do each of the multiple baselines

Q38: Describe and analyze the role and importance

Q39: When constructing and evaluating a theory,scientists follow

Q43: A potential solution to the problem of

Q52: Which of the following is a cognitive