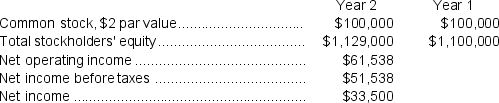

Groeneweg Corporation has provided the following data:  Dividends on common stock during Year 2 totaled $4,500.The market price of common stock at the end of Year 2 was $9.45 per share.The company's dividend payout ratio for Year 2 is closest to:

Dividends on common stock during Year 2 totaled $4,500.The market price of common stock at the end of Year 2 was $9.45 per share.The company's dividend payout ratio for Year 2 is closest to:

Definitions:

Capital Needs

The financial requirements a company has for carrying out its operations and investments, including the purchasing of assets and funding of projects.

Par Value

The nominal or face value of a bond, share of stock, or coupon as stated by the issuer.

Paid-In Capital

The amount of money that a company has received from shareholders in exchange for shares of stock.

Retained Earnings

The portion of net profits that are kept in the company rather than distributed to shareholders as dividends, often used for reinvestment in the business.

Q6: Which of these electron energy level patterns

Q35: The ion [Co(NH<sub>3</sub>)<sub>6</sub>]<sup>2+</sup> is octahedral and high

Q49: Predict which nucleus is less stable, <img

Q62: The simple rate of return focuses on

Q79: Beacham Corporation's net cash provided by operating

Q95: If the discount rate is 10%, the

Q104: Complete and balance the following redox

Q131: Marbry Corporation's balance sheet and income statement

Q149: The company's debt-to-equity ratio at the end

Q224: The formula for total asset turnover is: