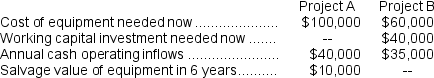

(Ignore income taxes in this problem.) Lambert Manufacturing has $100,000 to invest in either Project A or Project B. The following data are available on these projects:

Both projects will have a useful life of 6 years and the total cost approach to net present value analysis. At the end of 6 years, the working capital investment will be released for use elsewhere. Lambert's required rate of return is 14%.

Both projects will have a useful life of 6 years and the total cost approach to net present value analysis. At the end of 6 years, the working capital investment will be released for use elsewhere. Lambert's required rate of return is 14%.

-The net present value of Project B is:

Definitions:

Conservation of Number

A cognitive ability, identified by Piaget, where a child understands that the quantity of a set of items remains the same even if its appearance changes.

Cognitive Skill

The mental ability required for tasks that involve processing information, such as thinking, remembering, problem-solving, and paying attention.

Neo-Piagetian Research

A field of study that extends and modifies Jean Piaget's theory of cognitive development, incorporating new findings on information processing, memory capabilities, and individual differences in children.

Cognitive Functioning

Refers to the mental processes involved in acquiring knowledge and understanding, including thinking, knowing, remembering, judging, and problem solving.

Q32: Swagger Corporation purchases potatoes from farmers.The potatoes

Q36: The inventory turnover for Year 2 is

Q47: The net cash provided by (used in)financing

Q55: If management decides to buy part U98

Q62: The times interest earned ratio for Year

Q132: Landor Appliance Corporation makes and sells electric

Q148: The annual financial advantage (disadvantage)for the company

Q160: The company's current ratio is closest to:<br>A)0.26<br>B)2.65<br>C)0.50<br>D)0.53

Q214: Pribyl Corporation has provided the following financial

Q228: Gambino Corporation has provided the following financial