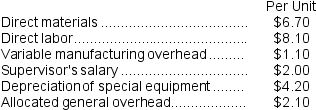

Norgaard Corporation makes 8,000 units of part G25 each year.This part is used in one of the company's products.The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to make and sell the part to the company for $21.20 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $2,000 of these allocated general overhead costs would be avoided.In addition, the space used to produce part G25 would be used to make more of one of the company's other products, generating an additional segment margin of $16,000 per year for that product. The annual financial advantage (disadvantage) for the company as a result of buying part G25 from the outside supplier should be:

An outside supplier has offered to make and sell the part to the company for $21.20 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $2,000 of these allocated general overhead costs would be avoided.In addition, the space used to produce part G25 would be used to make more of one of the company's other products, generating an additional segment margin of $16,000 per year for that product. The annual financial advantage (disadvantage) for the company as a result of buying part G25 from the outside supplier should be:

Definitions:

U.S. Tax Liability

The total amount of taxes owed to the U.S. government by an individual, corporation, or other entity in a given tax year.

Foreign Income Taxes

Taxes paid to a foreign government for income earned outside of the taxpayer's resident country, which may be credited against domestic taxes in some jurisdictions.

American Opportunity Tax Credit

A tax credit for eligible students to reduce education expenses, including tuition, fees, and course materials for the first four years of post-secondary education.

Qualifying Expenses

Specific costs deemed eligible by tax laws or other regulations that can be deducted or used for tax-advantaged purposes.

Q21: The "Travel expenses" in the flexible budget

Q57: Suppose that if the Doombug toy is

Q64: The Wyeth Corporation produces three products, A,

Q74: (Ignore income taxes in this problem.)The management

Q116: Cash equivalents on the statement of cash

Q120: Gehlhausen Corporation has provided the following financial

Q167: Bowen Company produces products P, Q, and

Q191: The administrative expenses in the planning budget

Q203: Pleiss Corporation applies manufacturing overhead to products

Q423: Magliacane Corporation is a service company that