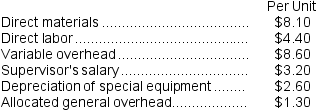

Recher Corporation uses part Q89 in one of its products.The company's Accounting Department reports the following costs of producing the 8,000 units of the part that are needed every year.  An outside supplier has offered to make the part and sell it to the company for $27.60 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $3,000 of these allocated general overhead costs would be avoided.In addition, the space used to produce part Q89 could be used to make more of one of the company's other products, generating an additional segment margin of $16,000 per year for that product.

An outside supplier has offered to make the part and sell it to the company for $27.60 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $3,000 of these allocated general overhead costs would be avoided.In addition, the space used to produce part Q89 could be used to make more of one of the company's other products, generating an additional segment margin of $16,000 per year for that product.

Required:

a.Prepare a report that shows the financial impact of buying part Q89 from the supplier rather than continuing to make it inside the company.

b.Which alternative should the company choose?

Definitions:

Conversion Costs

The costs incurred to convert raw materials into finished products, including direct labor and manufacturing overhead.

Weighted-Average Method

The weighted-average method is a cost accounting technique used to calculate inventory and cost of goods sold by assigning an average cost to each unit, based on the weight of those units in beginning inventory and purchases made.

Equivalent Units

In cost accounting, this is a metric that represents the work accomplished by unfinished units as if they were fully completed units.

Conversion Costs

Conversion costs are the expenses incurred to convert raw materials into finished goods, typically including labor and overhead costs.

Q39: The net operating income for Year 1

Q59: The payback period is closest to:<br>A)3.33 years<br>B)3.0

Q84: The net present value of Project A

Q103: The following information relates to last year's

Q105: The net present value of this investment

Q108: When a company is cash poor, a

Q135: Residual income should be used to evaluate

Q138: (Ignore income taxes in this problem.)A company

Q157: Cirone Inc.reported the following results from last

Q419: What is ChocO's materials (milk chocolate)price variance?<br>A)$56