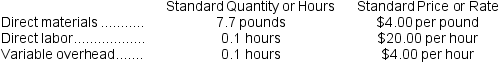

Milar Corporation makes a product with the following standard costs:

In January the company produced 2,000 units using 16,060 pounds of the direct material and 210 direct labor-hours. During the month, the company purchased 16,900 pounds of the direct material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable overhead cost was $756.

In January the company produced 2,000 units using 16,060 pounds of the direct material and 210 direct labor-hours. During the month, the company purchased 16,900 pounds of the direct material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable overhead cost was $756.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The materials quantity variance for January is:

Definitions:

Total Variable Cost

The sum of expenses that vary directly with the level of production output, excluding any fixed costs.

Marginal Cost

The additional cost incurred from producing one more unit of a product or service.

Decreasing Rate

A situation where the rate of growth or progression reduces over time.

Total Fixed Costs

The sum of all costs that do not change with the level of output, such as rent, salary, and insurance premiums.

Q29: Stallbaumer Incorporated makes a single product--an electrical

Q40: Trundle Corporation manufactures one product.The company uses

Q59: The revenue in the company's flexible budget

Q66: When the direct labor cost is recorded,

Q75: The margin for the investment opportunity is

Q106: Dori Castings is a job order shop

Q167: Bowen Company produces products P, Q, and

Q355: The materials quantity variance for January is:<br>A)$305

Q399: The amount shown for net operating income

Q448: The amount shown for "Other expenses" in