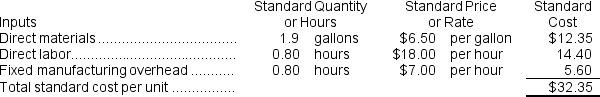

Ester Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $168,000 and budgeted activity of 24,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $168,000 and budgeted activity of 24,000 hours.

During the year, the company applied fixed overhead to the 22,600 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $149,800. Of this total, $83,800 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $66,000 related to depreciation of manufacturing equipment.

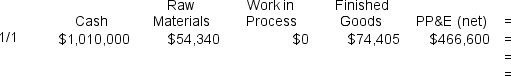

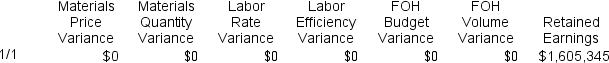

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When applying fixed manufacturing overhead to production,the Work in Process inventory account will increase (decrease) by:

Definitions:

Inward Curvature

The bending or curving of a structure towards the inside or center.

Lumbar Portion

The part of the lower back comprising the five lumbar vertebrae, often associated with back pain due to its weight-bearing function.

Lordosis

Abnormal anterior curvature of the lumbar spine.

Axial Skeleton

Consists of the bones along the body's long axis, including the skull, vertebral column, and rib cage, supporting the central part of the body.

Q12: When recording the raw materials used in

Q19: Reade Incorporated makes a single product--an electrical

Q21: The "Travel expenses" in the flexible budget

Q23: When recording the raw materials used in

Q56: The budgeted direct labor cost per unit

Q64: The variable overhead efficiency variance for the

Q64: The selling and administrative expense budget lists

Q99: The facility expenses in the flexible budget

Q201: A total of 6,850 kilograms of a

Q400: A partial standard cost card for the