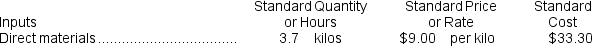

Lakatos Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. There is no variable manufacturing overhead. The standard cost card for the company's only product contains the following information concerning direct materials:

During the year, the company completed the following transactions concerning direct materials:

During the year, the company completed the following transactions concerning direct materials:

a. Purchased 151,800 kilos of raw material at a price of $9.70 per kilo.

b. Used 140,870 kilos of the raw material to produce 38,100 units of work in process.

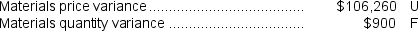

The company calculated the following direct materials variances for the year:

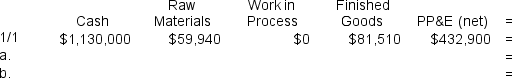

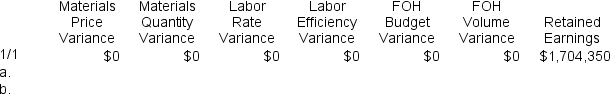

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When recording the raw materials used in production in transaction (b) above,the Work in Process inventory account will increase (decrease) by:

Definitions:

Dry Rot

A form of wood decay caused by fungi, leading to the wood becoming brittle and crumbly, often occurring in damp or poorly ventilated areas.

Auxiliary Supported Run-Flat

A type of run-flat tire design that includes additional support structures to allow a vehicle to continue driving at reduced speeds even after the tire has lost all air pressure.

Self-Supporting Run-Flat

A tire design that allows a vehicle to continue to be driven for a limited distance with no air pressure due to reinforced sidewalls.

Support Ring

A ring-shaped component used to reinforce or secure the position of another part within a system.

Q70: The budgeted accounts receivable balance at the

Q109: Suver Corporation has a standard costing system.The

Q137: The variable overhead rate variance for July

Q143: Pearlman Incorporated makes a single product--an electrical

Q157: Harris Corporation uses a standard cost system

Q174: The manufacturing overhead budget lists all costs

Q184: If 60,500 pounds of raw materials are

Q207: The revenue variance in the Revenue and

Q217: The labor rate variance for September is:<br>A)$3,675

Q290: The variable overhead rate variance for January