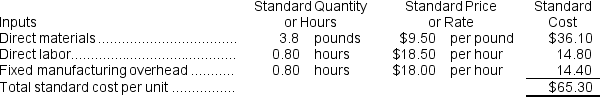

Robins Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $360,000 and budgeted activity of 20,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $360,000 and budgeted activity of 20,000 hours.

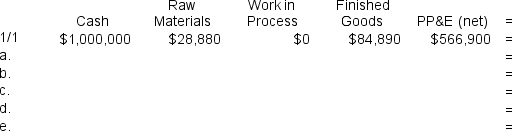

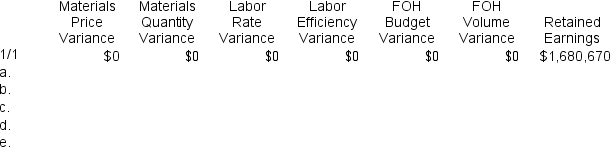

During the year, the company completed the following transactions:

a. Purchased 134,700 pounds of raw material at a price of $9.10 per pound.

b. Used 122,080 pounds of the raw material to produce 32,100 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 26,680 hours at an average cost of $17.20 per hour.

d. Applied fixed overhead to the 32,100 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $378,400. Of this total, $297,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $81,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 32,100 units from work in process to finished goods.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When recording the raw materials used in production in transaction (b) above,the Raw Materials inventory account will increase (decrease) by:

Definitions:

Cash Flow Statement

A financial document summarizing the total cash received from a company's operational activities and external financial sources, alongside all expenditures on business operations and investments over a specific timeframe.

Accounts Receivable

Money owed to a business by its customers for goods or services that have been delivered or used but not yet paid for.

Accounts Payable

Accounts payable is the amount a company owes to suppliers or vendors for goods or services received but not yet paid for, representing a short-term liability.

Gross Profit

The difference between sales revenue and the cost of goods sold, indicating the efficiency of a company in managing its production and labor costs.

Q6: The ending balance in the Retained Earnings

Q26: The medical supplies in the flexible budget

Q74: Expected cash collections in December are:<br>A)$68,000<br>B)$256,000<br>C)$320,000<br>D)$324,000

Q80: Darke Corporation makes one product and has

Q84: The budgeted cash receipts for October would

Q89: Pabon Corporation makes one product.Budgeted unit sales

Q128: The fixed overhead budget variance is:<br>A)$57,675 U<br>B)$15,000

Q208: If the budgeted cost of raw materials

Q232: If the total budgeted selling and administrative

Q338: Shiigi Urban Diner is a charity supported