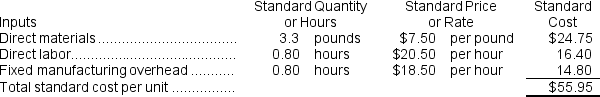

Kita Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

During the year, the company assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 24,820 hours at an average cost of $21.20 per hour.

During the year, the company assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 24,820 hours at an average cost of $21.20 per hour.

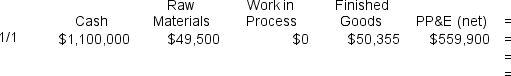

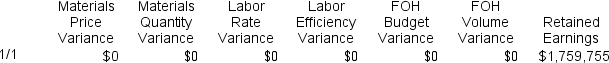

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When the direct labor cost is recorded,which of the following entries will be made?

Definitions:

Farm Prices

The prices that farmers receive for their products, including crops and livestock.

Automobile Production

The process and industry involved in designing, manufacturing, and selling motor vehicles.

Agricultural Sales

The total revenue generated from the sale of crops, livestock, and other farm products.

Farms Sales

The transaction and revenue activity related to the buying and selling of farm products and land.

Q35: The spending variance for facility expenses in

Q36: The ending balance in the Work in

Q63: Dobrowolski Corporation manufactures one product.It does not

Q127: When using segmented income statements, the dollar

Q167: The cost of December merchandise purchases would

Q176: The net income for December would be:<br>A)$39,300<br>B)$42,300<br>C)$32,900<br>D)$55,300

Q193: The budgeted required production for August is

Q216: The selling and administrative expenses in the

Q258: The variable overhead efficiency variance for July

Q264: The amount shown for "Servicing materials" in