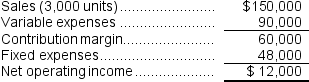

Laraia Corporation has provided the following contribution format income statement.All questions concern situations that are within the relevant range.  Required:

Required:

a.What is the contribution margin per unit?

b.What is the contribution margin ratio?

c.What is the variable expense ratio?

d.If sales increase to 3,050 units, what would be the estimated increase in net operating income?

e.If sales decline to 2,900 units, what would be the estimated net operating income?

f.If the selling price increases by $4 per unit and the sales volume decreases by 200 units, what would be the estimated net operating income?

g.If the variable cost per unit increases by $5, spending on advertising increases by $3,000, and unit sales increase by 450 units, what would be the estimated net operating income?

h.What is the break-even point in unit sales?

i.What is the break-even point in dollar sales?

j.Estimate how many units must be sold to achieve a target profit of $54,000.

k.What is the margin of safety in dollars?

l.What is the margin of safety percentage?

m.What is the degree of operating leverage?

n.Using the degree of operating leverage, what is the estimated percent increase in net operating income of a 15% increase in sales?

Definitions:

Competition-Based Method

Pricing strategy where the price of goods or services is determined by considering the prices of competitors’ products.

Total Cost Method

An accounting method that involves recording all production costs to inventory until the goods are sold, at which point they are expensed.

Markup

The amount added to the cost of a product to determine its selling price, usually expressed as a percentage of the cost.

Differential Analysis

The process of comparing the costs and benefits of alternative business decisions.

Q41: The Dover Corporation uses the FIFO method

Q50: The unit product cost under variable costing

Q58: Which of the following statements is true

Q64: If Casablanca expects to incur 185,000 machine

Q110: Alpha Corporation reported the following data for

Q126: The net operating income (loss)under absorption costing

Q128: How many units were started into production

Q151: The unit product cost under variable costing

Q156: Cassius Corporation has provided the following contribution

Q197: If the company's sales increase by 19%,