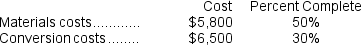

Esty Corporation uses the weighted-average method in its process costing system. This month, the beginning inventory in the first processing department consisted of 800 units. The costs and percentage completion of these units in beginning inventory were:

A total of 7,700 units were started and 6,600 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

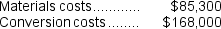

A total of 7,700 units were started and 6,600 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

The ending inventory was 70% complete with respect to materials and 10% complete with respect to conversion costs.

The ending inventory was 70% complete with respect to materials and 10% complete with respect to conversion costs.

Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

-What are the equivalent units for conversion costs for the month in the first processing department?

Definitions:

Executive Teams

Groups of individuals at the highest level of organizational leadership who are responsible for the strategic directions and decisions.

Diverse Products

A wide range of different products offered by a company to meet various customer needs and preferences.

Intense Competition

Refers to a market condition where companies or entities aggressively vie for customers, market share, or resources, often leading to innovative products and services but also aggressive marketing and strategic actions.

Complexity Leadership Theory

A framework that views leadership as a complex interplay between leaders, followers, and the organizational environment.

Q16: The company's unit contribution margin is closest

Q24: Skiver, Inc., manufactures and sells two products:

Q48: Laurant Corporation uses the FIFO method in

Q60: In the Schedule of Cost of Goods

Q80: Overhead allocation based solely on a measure

Q88: The company's unit contribution margin is closest

Q97: What total amount of cost should be

Q147: In the most recent month, Sardella Corporation's

Q213: Flyer Corporation manufactures two products, Product A

Q226: This question is to be considered independently