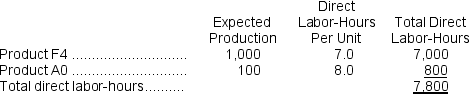

Macfarlane, Inc., manufactures and sells two products: Product F4 and Product A0.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $27.60 per DLH.The direct materials cost per unit for each product is given below:

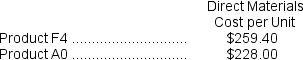

The direct labor rate is $27.60 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

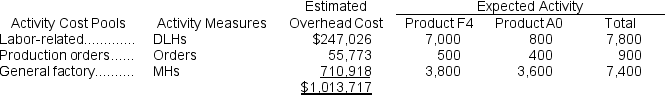

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

Required:

Determine the unit product cost of each product under the activity-based costing method.

Definitions:

Fixed Purchase Contract

A contractual agreement to buy or sell goods and services at predetermined prices and terms.

Journal Entry

A record in the books of accounts that represents each transaction with debits and credits recorded to maintain the accounting equation.

Lower of Cost or Market

An accounting principle requiring inventory to be recorded at either its historical cost or its current market value, whichever is lower.

Inventory Valuation

The method used by businesses to assess their inventory's worth at the end of an accounting period, affecting financial statements and tax obligations.

Q54: All production costs have been steadily rising

Q55: Activity-based costing uses a number of activity

Q56: Departmental overhead rates may not correctly assign

Q63: Mcie Corporation is a manufacturer that uses

Q67: If the materials handling cost is allocated

Q68: If the company allocates all of its

Q70: Using the high-low method, the fixed portion

Q173: An employee time ticket is used to

Q178: The overhead cost per unit of Product

Q290: Which of the following is the correct