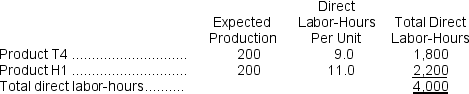

Steuart, Inc., manufactures and sells two products: Product T4 and Product H1.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $26.00 per DLH.The direct materials cost per unit for each product is given below:

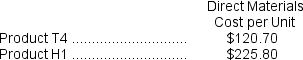

The direct labor rate is $26.00 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

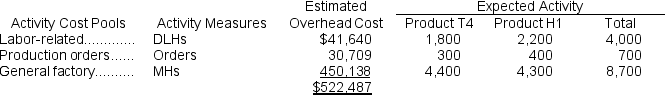

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

Required:

What is the difference between the unit product costs under the traditional costing method and the activity-based costing system for each of the two products?

Definitions:

Revenue Recognition

The accounting principle that determines the specific conditions under which income becomes realized as revenue, often at the time of sale or service delivery.

Gross Profit

The difference between revenue from sales and the cost of goods sold, indicating the amount before deducting operating expenses, taxes, and other charges.

Merchandiser

A business entity that purchases goods for resale at a profit, engaging in activities that include buying, storing, and selling merchandise.

Perpetual Inventory System

An accounting method where inventory levels are updated in real-time after every receipt or sale of items.

Q20: Malcolm Company uses a weighted-average process costing

Q52: Seuell Inc.has provided the following data for

Q59: Cabio Company manufactures two products, Product C

Q60: The Richmond Corporation uses the weighted-average method

Q71: Clarks Corporation uses the FIFO method in

Q82: Ellithorpe Corporation has provided the following data

Q102: Anders Inc.uses the weighted-average method in its

Q140: Lindsey Company uses activity-based costing.The company has

Q220: The predetermined overhead rate for the Machining

Q238: The direct materials cost for July is:<br>A)$55,000<br>B)$69,000<br>C)$63,000<br>D)$66,000