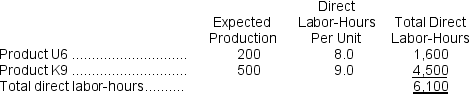

Rutty, Inc., manufactures and sells two products: Product U6 and Product K9.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $28.70 per DLH.The direct materials cost per unit for each product is given below:

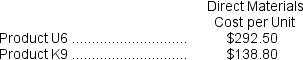

The direct labor rate is $28.70 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

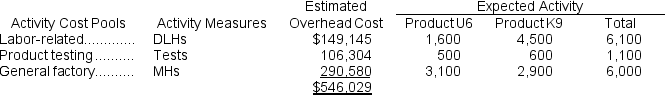

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

Required:

In all computations involving dollars in the following requirements, round off your answer to the nearest whole cent.

a.Determine the unit product cost of each product under the company's traditional costing method.

b.Determine the unit product cost of each product under the activity-based costing method.

Definitions:

Sunk Cost

A cost that has already been incurred and cannot be recovered, which should not influence future business decisions.

Fixed Cost Financing

A financing strategy where the costs remain constant regardless of the level of production or sales.

Future Cash Flows

Expected cash receipts and payments a business anticipates receiving or paying out over a future period.

Bias

A preconception or inclination towards something, potentially leading to unfair judgments or decisions in various contexts.

Q8: What are the equivalent units for materials

Q13: Using the FIFO method, the equivalent units

Q33: Placker Corporation uses a job-order costing system

Q36: What are the equivalent units for conversion

Q75: How much is the cost of goods

Q88: Gelinas, Inc., manufactures and sells two products:

Q121: If the materials handling cost is allocated

Q190: A bill of materials is a document

Q192: Assume that the company uses departmental predetermined

Q220: The activity rate for the General Factory