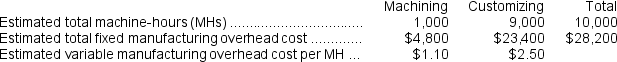

Janicki Corporation has two manufacturing departments--Machining and Customizing. The company used the following data at the beginning of the year to calculate predetermined overhead rates:

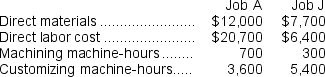

During the most recent month, the company started and completed two jobs--Job A and Job J. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job A and Job J. There were no beginning inventories. Data concerning those two jobs follow:

-Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments.Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices.The calculated selling price for Job J is closest to:

Definitions:

Food Workers

Individuals engaged in occupations related to the preparation, distribution, and serving of food, often in the hospitality and retail sectors.

U.S. Bureau of Labor Statistics

A federal agency responsible for collecting and analyzing economic data related to labor market activity, working conditions, and price changes in the economy.

Commissions

Payments made to salespersons or agents based on the sale amount or value they generate, often a percentage of the sales price.

Royalties

Payments made by one party (the licensee) to another (the licensor) for the use of a particular asset, such as intellectual property.

Q44: Menk Corporation has provided the following information:

Q46: The adjusted cost of goods sold for

Q71: The total of the manufacturing overhead costs

Q104: Random assignment _ that the research groups

Q107: A(n)_ strategy is one where a set

Q157: The cost of goods sold for June

Q171: The credits to the Manufacturing Overhead account

Q177: If Job #461 contained 100 units, the

Q207: A factory supervisor's salary would be classified

Q243: What is the total of the product