(Appendix 2A) Adelberg Corporation makes two products: Product A and Product B. Annual production and sales are 500 units of Product A and 1,000 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.4 direct labor-hours per unit and Product B requires 0.2 direct labor-hours per unit. The total estimated overhead for next period is $68,756.

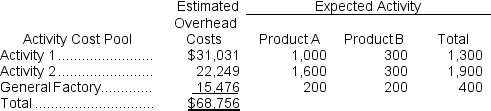

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

-The overhead cost per unit of Product B under the activity-based costing system is closest to:

Definitions:

Humid Days

Days characterized by a high level of moisture or water vapor in the atmosphere, often feeling much hotter due to the reduced effectiveness of sweating.

Polonium

A rare and highly radioactive metalloid with the chemical symbol Po, used in research and sometimes in anti-static devices.

Radioisotopes

Atoms that have excess nuclear energy, making them unstable and radioactive.

Q36: What are the equivalent units for conversion

Q49: Property taxes are an example of a

Q50: The best estimate of the total variable

Q73: Vallin Manufacturing Corporation's beginning work in process

Q100: Emigh Corporation's cost of goods manufactured for

Q108: Upwall, Inc., manufactures and sells two products:

Q116: The total job cost for Job P951

Q166: The manufacturing overhead for the year was:<br>A)$6,000

Q195: Entry (4)in the below T-account could represent

Q234: The raw materials purchased during May totaled:<br>A)$58,500<br>B)$67,500<br>C)$54,000<br>D)$63,000