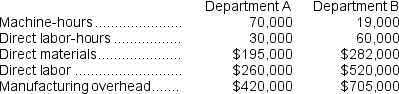

Dotsero Technology, Inc., has a job-order costing system.The company uses predetermined overhead rates in applying manufacturing overhead cost to individual jobs.The predetermined overhead rate in Department A is based on machine-hours, and the rate in Department B is based on direct materials cost.At the beginning of the most recent year, the company's management made the following estimates for the year:  Job 243 entered into production an April 1 and was completed on May 12.The company's cost records show the following information about the job:

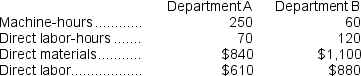

Job 243 entered into production an April 1 and was completed on May 12.The company's cost records show the following information about the job:  At the end of the year, the records of Dotsero showed the following actual cost and operating data for all jobs worked on during the year:

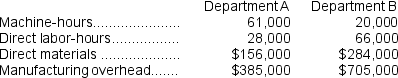

At the end of the year, the records of Dotsero showed the following actual cost and operating data for all jobs worked on during the year:  Required:

Required:

a.Compute the predetermined overhead rates for Department A and Department B.

b.Compute the total overhead cost applied to Job 243.

c.Compute the amount of underapplied or overapplied overhead in each department at the end of the current year.

Definitions:

Shipper and Carrier

A shipper is a person or company sending goods; a carrier is the party responsible for the transport of those goods.

Contract

A legally binding agreement between two or more parties that is enforceable by law.

Environmental Performance

Refers to an organization’s impact on the environment, including the ways in which it manages resources and waste to mitigate harmful effects.

Cost Reductions

Strategies and actions taken to lower expenses and improve efficiency.

Q2: Thach Corporation uses a job-order costing system

Q13: Rutty, Inc., manufactures and sells two products:

Q34: The estimated total manufacturing overhead for the

Q62: During July at Loeb Corporation, $83,000 of

Q104: If the company allocates all of its

Q114: The unit product cost of Product A4

Q201: Tirri Corporation has provided the following information:

Q260: Differential costs can only be variable.

Q268: Leeds Corporation uses a job-order costing system

Q273: Steele Corporation uses a predetermined overhead rate