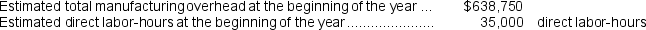

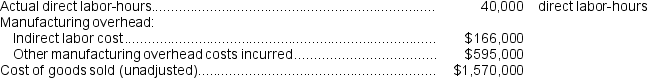

Molin Corporation is a manufacturer that uses job-order costing.The company closes out any overapplied or underapplied overhead to Cost of Goods Sold at the end of the year.The company has supplied the following data for the just completed year:  Results of operations:

Results of operations:  Required:

Required:

a.What is the total amount of manufacturing overhead applied to production during the year?

b.Is manufacturing overhead overapplied or underapplied for the year? By how much?

c.What is the adjusted cost of goods sold for the year?

Definitions:

Total Costs

Total costs are the sum of all expenses incurred in the production of goods or services, including both fixed and variable costs.

Total Variable Costs

The summation of all costs that vary with the level of output, such as raw materials and labor costs, differing from fixed costs.

Total Fixed Costs

The sum of all costs required to produce any good or service, that do not change with the volume of production.

Average Variable Costs

The total variable expenses of producing an item, divided by the quantity of items produced, accounting for costs that change with the production volume.

Q7: The cost of ending work in process

Q22: When manufacturing overhead is applied to production,

Q42: The cost per equivalent unit for conversion

Q54: The predetermined overhead rate is closest to:<br>A)$8.80

Q57: The unit product cost for Job T498

Q69: Marius Corporation has two production departments, Casting

Q181: Direct labor is an appropriate allocation base

Q202: The total overhead applied to Product P4

Q223: The ending Work in Process account balance

Q238: Which of the following costs is classified