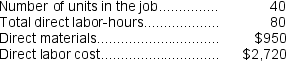

Lueckenhoff Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $497,000, variable manufacturing overhead of $2.40 per direct labor-hour, and 70,000 direct labor-hours. The company has provided the following data concerning Job T498 which was recently completed:

-The unit product cost for Job T498 is closest to:

Definitions:

Judicial Dissociation

The process by which a court may remove a member from a limited liability company (LLC) based on legal grounds.

Winding Up

The process of concluding a business's operations and distributing its assets to claimants, typically as part of liquidation or in preparation for dissolution.

Transferable Partnership Interest

The right of a partner to transfer their share of the partnership's profits, losses, and distributions to another party, subject to the terms of the partnership agreement.

Charging Order

A court order directing the interests of a debtor in a partnership or LLC to be given to a creditor, as a means of satisfying the debtor's outstanding debt.

Q25: The predetermined overhead rate under the traditional

Q30: In a traditional format income statement for

Q63: The total of the product costs listed

Q68: The journal entry to record the allocation

Q69: Marius Corporation has two production departments, Casting

Q108: An example of a committed fixed cost

Q202: The costs of direct materials are classified

Q226: The estimated total manufacturing overhead for the

Q242: The estimated total manufacturing overhead for the

Q265: The amount of overhead applied in the