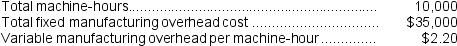

Sutter Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours.The company based its predetermined overhead rate for the current year on the following data:  Recently, Job T369 was completed with the following characteristics:

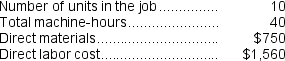

Recently, Job T369 was completed with the following characteristics:  If the company marks up its unit product costs by 20% then the selling price for a unit in Job T369 is closest to:

If the company marks up its unit product costs by 20% then the selling price for a unit in Job T369 is closest to:

Definitions:

Pre-Tax Book Income

The income of a business before taking into account any tax liabilities, reflecting the company's financial performance without the impact of tax expenses.

Taxable Income

The portion of an individual's or entity's income used to determine how much tax is owed to the government, after all deductions and exemptions are applied.

Pre-Tax Operating Loss

The loss a company incurs from its operations before accounting for taxes, indicating how well the core business is performing.

Carryback

A tax provision that allows individuals or businesses to apply a current year's net operating losses to previous years' profits to reduce tax liabilities.

Q12: Longobardi Corporation bases its predetermined overhead rate

Q17: Fossil Manufacturing uses a predetermined overhead rate

Q73: Macy Corporation's relevant range of activity is

Q98: Farrel Corporation is a manufacturer that uses

Q122: The activity rate for the batch setup

Q158: The unit product cost of Product N0

Q158: Sutter Corporation uses a job-order costing system

Q176: The manufacturing overhead was:<br>A)$10,000 Underapplied<br>B)$10,000 Overapplied<br>C)$55,000 Underapplied<br>D)$55,000

Q188: The amount of overhead applied in the

Q211: In the Schedule of Cost of Goods