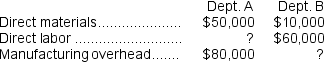

Grib Corporation uses a predetermined overhead rate based on direct labor cost to apply manufacturing overhead to jobs.The predetermined overhead rates for the year are 200% of direct labor cost for Department A and 50% of direct labor cost for Department B.Job 436, started and completed during the year, was charged with the following costs:  The total manufacturing cost assigned to Job 436 was:

The total manufacturing cost assigned to Job 436 was:

Definitions:

Multiple Regression

A statistical method leveraging numerous independent variables to predict the behavior of a response variable.

Linear Regression

A statistical method used to model the relationship between a dependent variable and one or more independent variables, assuming a linear relationship.

Independent Variable

The treatment variable that is manipulated or the predictor variable in a regression equation.

Repeated-Measures ANOVA

A type of analysis of variance that involves multiple measurements of the same individuals under different conditions.

Q28: The ending balance in the Raw Materials

Q62: The incremental manufacturing cost that the company

Q79: Beat Corporation uses a job-order costing system

Q126: If 3,000 units are produced, the total

Q139: If the overhead rate is computed annually

Q163: The journal entry for cost of goods

Q201: The unit product cost of Product B7

Q209: The balance in the raw materials inventory

Q236: If the company marks up its unit

Q253: The debits entered in the Raw Materials