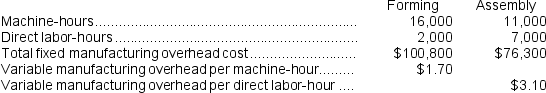

Gercak Corporation has two production departments, Forming and Assembly.The company uses a job-order costing system and computes a predetermined overhead rate in each production department.The Forming Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours.At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job X560.The following data were recorded for this job:

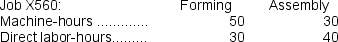

During the current month the company started and finished Job X560.The following data were recorded for this job:  Required:

Required:

a.Calculate the estimated total manufacturing overhead for the Assembly Department.

b.Calculate the predetermined overhead rate for the Forming Department.

c.Calculate the total amount of overhead applied to Job X560 in both departments.

Definitions:

Normal Spoilage Costs

Costs associated with the expected amount of waste or inefficiency during a production process, considered a normal part of manufacturing.

Direct Materials Price Standard

The predetermined cost per unit of material, used in setting a budget and controlling costs.

Handling Costs

Expenses associated with the processing, transporting, and storing of goods throughout the supply chain.

Standard Labor Cost

The predetermined cost of labor assumed in the production of goods or services, used for budgeting and measuring efficiency.

Q2: Between-subjects designs and within-subjects designs are both

Q32: Which of the following approaches to preparing

Q76: The robustness of statistical test is determined

Q89: The contribution margin for December is:<br>A)$530,400<br>B)$227,700<br>C)$1,252,800<br>D)$362,100

Q107: The unit product cost for Job P978

Q123: The predetermined overhead rate is closest to:<br>A)$11.90

Q166: The unit product cost for Job K332

Q204: The predetermined overhead rate for the Customizing

Q280: The estimated total manufacturing overhead is closest

Q297: If the selling price is $18.70 per