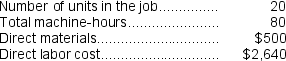

Levron Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $58,000, variable manufacturing overhead of $2.00 per machine-hour, and 20,000 machine-hours. The company has provided the following data concerning Job P978 which was recently completed:

-The unit product cost for Job P978 is closest to:

Definitions:

Liabilities

Financial obligations or debts that an entity owes to others, which are expected to be settled over time through the transfer of economic benefits.

Accumulated Depreciation

Accumulated depreciation represents the total amount of depreciation expense that has been recorded against a fixed asset since it was acquired and put into use.

Retained Earnings

The amount of net income left over for a business after it has paid out dividends to its shareholders.

Journalizing

Journalizing is the process of recording transactions in the accounting journals as part of the double-entry bookkeeping system.

Q27: A number of costs are listed below.

Q28: The amount of overhead applied to Job

Q78: The cost of goods manufactured is:<br>A)$82,000<br>B)$64,000<br>C)$71,000<br>D)$62,000

Q101: Brault Corporation has provided the following information:

Q128: Busche, Inc., manufactures and sells two products:

Q145: If a company uses a predetermined overhead

Q192: Assume that the company uses departmental predetermined

Q210: Assume that the company uses departmental predetermined

Q241: What is the journal entry to record

Q287: Stockmaster Corporation has two manufacturing departments--Forming and