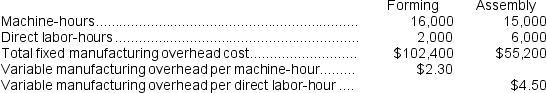

Ahlheim Corporation has two production departments, Forming and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Forming Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:

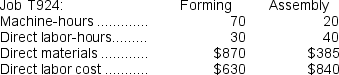

During the current month the company started and finished Job T924. The following data were recorded for this job:

During the current month the company started and finished Job T924. The following data were recorded for this job:

-The estimated total manufacturing overhead for the Assembly Department is closest to:

Definitions:

Parent Company

A company that has controlling interest in another company or companies, known as subsidiaries.

Subsidiary

A company that is controlled by another company, known as the parent company, through ownership of more than half of its voting stock.

Fixed Assets

Long-term tangible assets used in operation of a business that are unlikely to be converted into cash within a short period.

Consolidated Financial Statements

Financial statements that represent the aggregate financial position and results of operations for a parent company and its subsidiaries as a single economic entity.

Q5: Amason Corporation has two production departments, Forming

Q34: It is entirely possible for two variables

Q48: An advantage of matching over holding a

Q68: Baj Corporation uses a predetermined overhead rate

Q76: Dobosh Corporation has provided the following information:

Q118: An investigator was interested in determining if

Q136: The amount of overhead applied in the

Q144: Mundorf Corporation has two manufacturing departments--Forming and

Q187: How much is the cost of goods

Q189: The amount of overhead applied in the