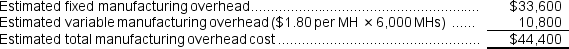

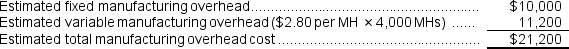

Fee The first step is to calculate the estimated total overhead costs in the two departments.

Machining

Customizing

Customizing

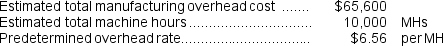

The second step is to combine the estimated manufacturing overhead costs in the two departments ($44,400 + $21,200 = $65,600) to calculate the plantwide predetermined overhead rate as follow:

The second step is to combine the estimated manufacturing overhead costs in the two departments ($44,400 + $21,200 = $65,600) to calculate the plantwide predetermined overhead rate as follow:

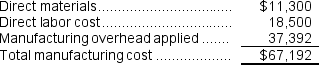

The overhead applied to Job C is calculated as follows:

The overhead applied to Job C is calculated as follows:

Overhead applied to a particular job = Predetermined overhead rate x Machine-hours incurred by the job

= $6.56 per MH x (4,100 MHs + 1,600 MHs)

= $6.56 per MH x (5,700 MHs)

= $37,392

Job C's manufacturing cost:

Reference: CH02-Ref24

Reference: CH02-Ref24

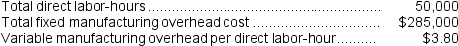

Prather Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data:

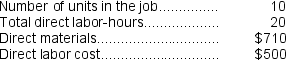

Recently, Job P513 was completed with the following characteristics:

Recently, Job P513 was completed with the following characteristics:

-The predetermined overhead rate is closest to:

Definitions:

Congenital Heart Disease

A heart abnormality present at birth, involving the structure of the heart walls, chambers, or valves.

Congenital Anomaly

A medical condition or physical irregularity that is present from birth, resulting from genetic or environmental factors.

Intelligence Quotient

A measure of a person's intellectual abilities compared with the average population, typically assessed by standardized tests.

Cognitive Impairment

A reduction in cognitive functions such as memory, decision-making, or problem-solving, significant enough to interfere with daily life.

Q68: Random assignment is feasible only when an

Q138: The amount of overhead applied to Job

Q155: Entry (16)in the below T-account represents the

Q156: If 8,000 units are produced, the total

Q156: The predetermined overhead rate is closest to:<br>A)$26.40<br>B)$25.14<br>C)$23.43<br>D)$24.60

Q191: For financial reporting purposes, the total amount

Q230: Levi Corporation uses a predetermined overhead rate

Q234: The raw materials purchased during May totaled:<br>A)$58,500<br>B)$67,500<br>C)$54,000<br>D)$63,000

Q244: Bauman Sales Corporation, a merchandising company, reported

Q286: If the company marks up its unit