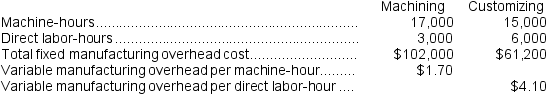

Collini Corporation has two production departments, Machining and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Machining Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:

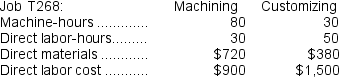

During the current month the company started and finished Job T268. The following data were recorded for this job:

During the current month the company started and finished Job T268. The following data were recorded for this job:

-The total amount of overhead applied in both departments to Job T268 is closest to:

Definitions:

Earnings

The amount of money that a company makes during a specific period, usually defined as profit after all expenses have been subtracted from revenue.

Dividends

Payments made by a corporation to its shareholder members, typically a portion of the earnings decided by the board of directors.

Asset Turnover Ratio

A financial metric that measures the efficiency of a company in generating sales revenue from its assets.

Financial Statements

Consolidated documents showing the financial health of an entity, including balance sheets, income statements, and cash flow statements.

Q2: In the Excel, or spreadsheet, approach to

Q8: The estimated total manufacturing overhead for the

Q44: Braegelmann Corporation has two production departments, Casting

Q91: Given the cost formula Y = $23,000

Q162: Doles Corporation uses the following activity rates

Q213: The predetermined overhead rate for the Forming

Q239: The amount of overhead applied to Job

Q239: Fixed costs expressed on a per unit

Q256: In a job-order costing system, indirect labor

Q282: Lotz Corporation has two manufacturing departments--Casting and