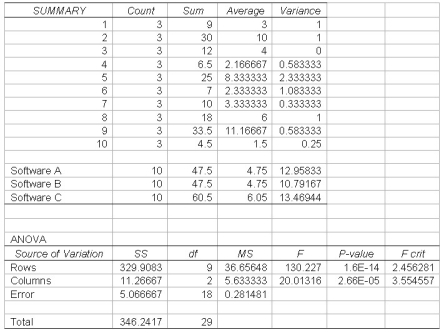

A test is conducted to compare three difference income tax software packages to determine whether there is any difference in the average time it takes to prepare income tax returns using the three different software packages.Ten different people's income tax returns are done by each of the three software packages and the time is recorded for each.The computer results are shown below.  Based on these results and using a 0.05 level of significance which is correct regarding blocking?

Based on these results and using a 0.05 level of significance which is correct regarding blocking?

Definitions:

Proportional

Pertaining to a relationship or situation where two quantities vary directly with each other.

Taxable Income

The amount of income that is subject to taxation, after all allowable deductions, credits, and exemptions.

Total Income

The sum of all earnings received by an individual or entity, encompassing wages, salaries, profits, rents, and other forms of earnings.

Progressive Tax

A taxation system where the tax rate increases as the taxable amount or income increases, placing a higher burden on wealthier individuals.

Q22: A national car rental chain believes that

Q23: There have been complaints recently from homeowners

Q24: While virtually all time series exhibit a

Q32: If the population correlation between two variables

Q45: A dummy variable is a dependent variable

Q49: A perfect correlation between two variables will

Q50: The Department of Weights and Measures in

Q94: In order to identify a cyclical component

Q123: In conducting a hypothesis test where the

Q128: The chamber of commerce in a beach