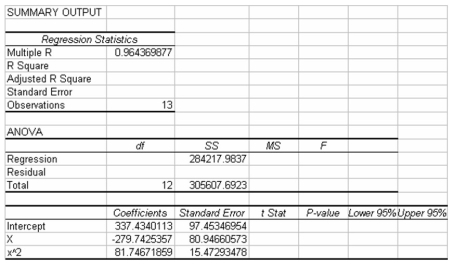

The following output is for a second-order polynomial regression model where the independent variables are x and x2 (x^2).Some of the output has been omitted.  Considering the above information,the model explains approximately 56.7 percent of the variation in the y variable.

Considering the above information,the model explains approximately 56.7 percent of the variation in the y variable.

Definitions:

Black-Scholes Option Pricing Model

The Black-Scholes Option Pricing Model is a mathematical model for valuing the price of European style options, taking into account factors like stock price, exercise price, time to expiration, and volatility.

Black-Scholes Option Pricing Model

A mathematical model used for deriving the theoretical price of European call and put options, factoring in the impact of time, volatility, and other variables.

Pure Discount Bond

A type of bond that is sold at a discount to its face value, pays no interest to the holder, and is redeemed at its full face value at maturity.

Risk-Free Rate

The theoretical return on an investment with zero risk, often represented by the yield on government securities.

Q2: The standard error of the estimate is

Q16: A study published in the American Journal

Q18: If the calculated chi-square statistic is large,this

Q33: As a step in establishing its rates,an

Q42: The Boxer Company has been in business

Q64: Many companies use well-known celebrities as spokespeople

Q101: A study published in the American Journal

Q106: A decision tree can show only one

Q119: A stockbroker at a large brokerage firm

Q133: Which of the following is the minimum